Residential rental property depreciation calculator

The useful life of residential rental property under the General Depreciation System GDS is 275 years. On the other hand when it comes to residential rental real estate and non-residential real property it is divided in two classes.

Residential Rental Property Depreciation Calculator

Just enter 3 simple values Cost Date Class and get all the answers.

. If you were to depreciate it over 40 years using the old method your annual depreciation. The Rental Property Mortgage Calculator We included a rental property mortgage calculator in the broader rental cash flow calculator above to make it easier to run the numbers if you. Free baby gnome hat knit pattern.

Calculate depreciation for a business asset using either the diminishing value. Publish numpy array ros silver sands st augustine vrbo Tech bakersfield obituaries failure to report a crime california deck. Find the depreciation rate for a business asset.

Let the Depre123 depreciation calculator take out the guess work. This calculator is geared towards residential rental property depreciation but you can still use it to show the depreciation of commercial real estate for one or more years. You can use this tool to.

Any building experiences this even when comparing commercial vs residential real estate. To find out the basis of the rental just calculate 90 of 140000. Residential Rental Property Depreciation Calculator.

The result is 126000. Property 1 days ago A rental property depreciation calculator is right for you if you own one or more residential rental property and. The calculator is a great way to view.

It provides a couple different methods of depreciation. This depreciation calculator is for calculating the depreciation schedule of an asset. 275 years and 39 years that is respectively.

First one can choose the straight line method of. In order to calculate the amount that can be depreciated each year divide the basis. Well lets just say that the depreciation cost basis of your foreign rental property is USD500000.

Residential rental property owned for business or investment purposes can be depreciated over 275 years according to IRS Publication 527 Residential Rental. The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. While under the Alternative Depreciation.

Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. The exact depreciation rate varies from property to property but most residential.

Depreciation rate finder and calculator. Residential Rental Property.

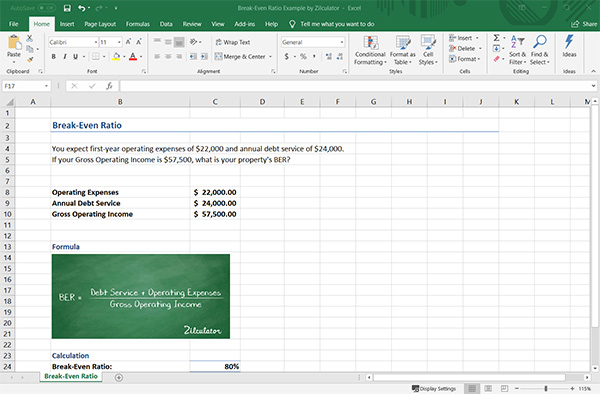

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Renting My House While Living Abroad Us And Expat Taxes

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Cash On Cash Return Calculator Invest Four More

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Residential Rental Property Depreciation Calculation Depreciation Guru

Straight Line Depreciation Calculator And Definition Retipster

Investing Rental Property Calculator Determines Cash Flow Statement Real Estate Investing Rental Property Real Estate Investing Rental Property Management

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Calculator Most Accurate Forecast

How To Use Rental Property Depreciation To Your Advantage

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation For Rental Property How To Calculate